Executive Summary

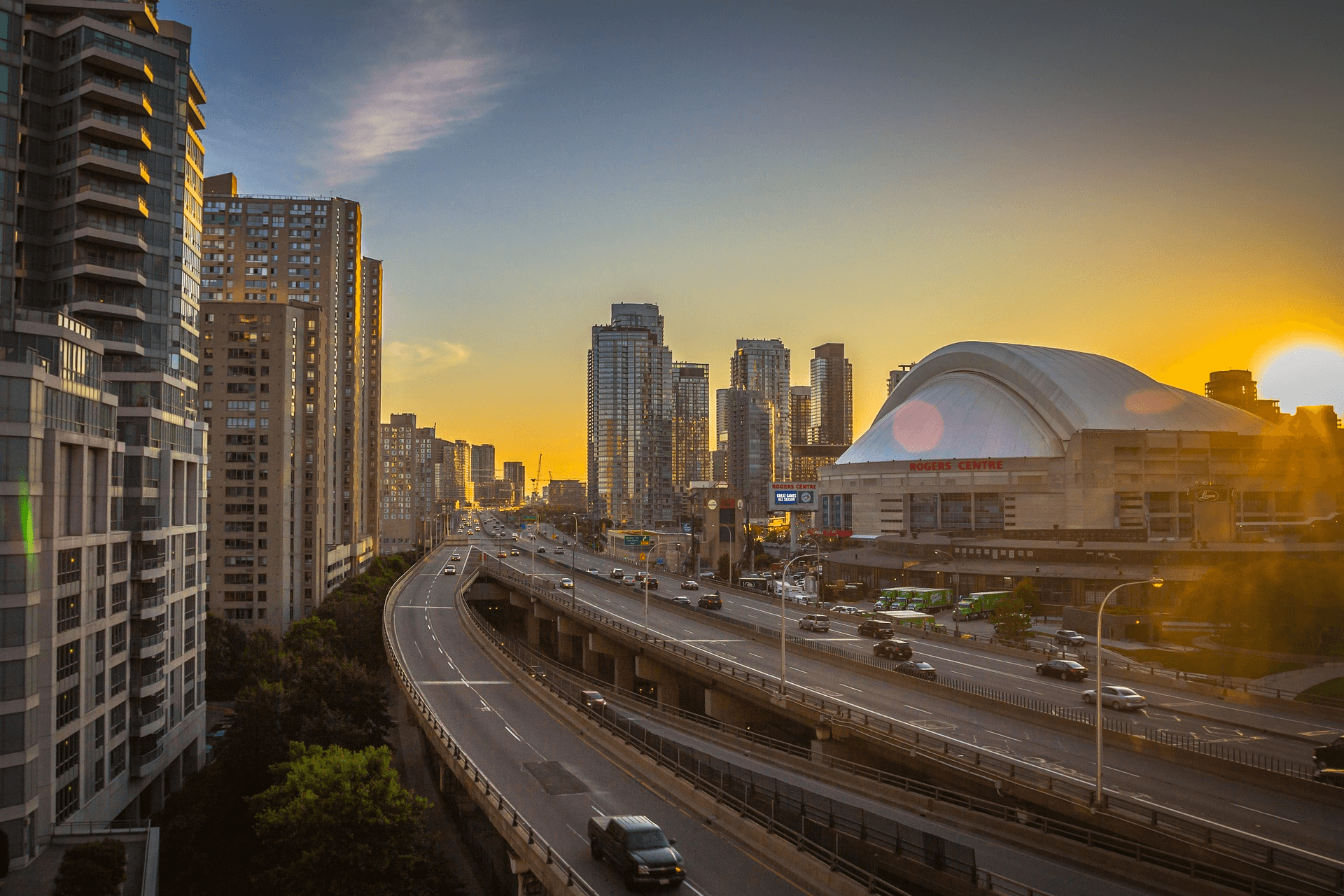

Businesses engaged in financial services keenly understand a fundamental adage of profitability in their sector: it costs much more to attract a new customer than to retain an existing one. The insurance industry has the highest customer acquisition costs of any industry, varying from seven to nine times more to attract a new customer than to retain one, according to an article on Independent Insurance Agents of Dallas.2 The same article cited that the average customer retention rate in the insurance industry is 84% in comparison with a 93% to 95% retention rate maintained by the top five companies in a wide span of industries. That 10% difference represents a sizeable loss of profitability. Clearly, loyalty matters. There is both an art and a science to keeping customers engaged in your brand, and this is particularly important when it comes to usage-based insurance programs during an era in which many policyholders are actively considering alternatives to their current insurers.

When customer retention is stable, insurers have a better opportunity to engage with customers more regularly. Frequent engagement touchpoints can be used encourage safer driving practices, offer enhanced services, handle risk issues with more immediacy, and establish a closer relationship with policyholders.