How usage-based and digital insurtech solutions can give control back to policyholders in a post-COVID world.

There can be no doubt that the pandemic has changed driving. With fewer people making a daily work commute and many also choosing to socialize less, auto usage has declined significantly, both in North America and Europe. This is prompting drivers to demand better value and more control from their auto insurance, in the form of pricing and policies that better reflect the way they use their cars. In this article, we explore the two key reasons why drivers want smarter insurance (it’s not just covid) and explore car insurance based on mileage as a solution.

Reason one: the pandemic

For many insurers, this has been the elephant in the room for some time – and it’s easy to see why. Earlier in the pandemic, when many countries were imposing their most stringent restrictions, many office workers ceased to commute altogether. But that didn’t last long. As vaccines became more widely available and governments shifted their focus to the way in which we can live with covid long-term, the days of staying at home every day came to an end. Or did they? Because even now, the idea that car use will completely return to pre-pandemic levels seems a little far-fetched. Working from home – at least some of the time – seems to be here to stay. Which explains the fact that driving has simply not returned to pre-pandemic levels, in Europe, US or Canada. Across the board, both frequency and distance traveled remain significantly lower than they were.

But insurance premiums didn’t change

Anyone who uses their car less is likely to look at whether they should continue to pay the same price of insurance. And while few drivers are expected to give up their cars altogether, many will expect their insurance costs to drop in line with their vehicle usage.

The opportunity: accurate mileage-based car insurance

The net effect of this change has been an immediate surge in the popularity of usage-based and mileage-based auto insurance programs, as policyholders demand more control over their products and the premiums they pay. It has led to a plethora of new insurance companies launching pay-per-mile products led by accurate connected car data, to answer the needs of consumers driving fewer miles. Telematics driven pay-per-mile insurance programs mean insurers receive accurate reporting, which is equally important to the policyholder to “accurately prove” they are driving much less. Consequently, there is now a real opportunity for any auto insurer to offer these mileage-based auto insurance, using connected car data as a basis for delivery.

Reason two: social justice reform

The pandemic hasn’t been the only issue to hog the headlines in recent months. A parallel trend has been the growth in pressure for social justice reform and greater equality/fairness. For insurers, this means greater scrutiny, as traditional rating methods (using criteria based on past or suppressing variables such as income, home location, credit scores and past convictions) can have an unfair impact on society.

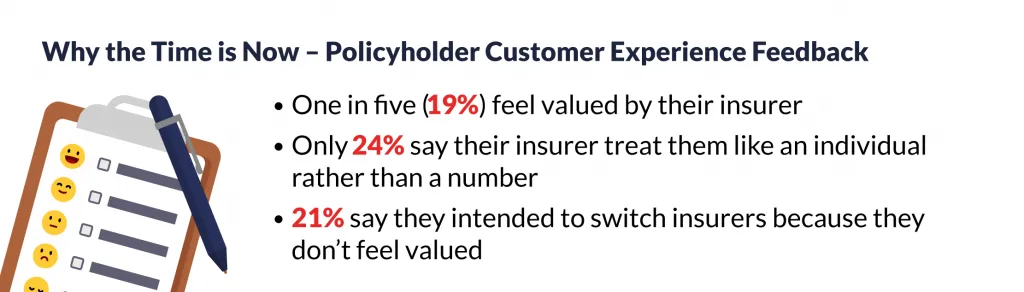

Policyholders from all demographic groups are exhibiting signs of dissatisfaction with their insurers. Only one in five drivers feel valued by their insurers – and just 24% say their insurer treats them as an individual, rather than a number. Many feel they lack control and, in part for reasons outlined above, they seek policies that reflect how, where, and how often they drive.

A key reason for the current customer dissatisfaction is the fact that even today, many insurers are still not taking advantage of the full capabilities of mileage-based auto insurance because it measures how people are driving today, and not the past. Telematics-based mileage programs factor what drivers pay based on current and real-time usage variables enabling all to have fair and equitable insurance.

Telematics and connected car data is the solution

Telematics data measures exactly how, how much, when and where a person drives. Not only are these factors several times more powerful than traditional factors, but their use also means an insurer can move beyond methods that are now being recognized as unfair to some groups. At least two insurtech insurers have recently announced their intent to avoid using insurance credit scoring, favoring telematics data instead.

Data is the way forward

Right now, data-driven programs represent the best answer to the market’s changing needs. Which is why telematics driven mileage-based auto insurance programs, often referred to as Pay-As-You-Drive (PAYD) or pay per mile, are now gaining traction. And they are growing more sophisticated by the day. Already, some enable policyholders to buy blocks of milage in advance, buy on-demand and even top-up when they are starting to run low. Mileage-based solutions not only record the actual miles travelled, but they can also personalize the cost of each mile according to factors such as where the driver is driving, the time of day, the type of road and more.

Best of all, both usage-based and mileage-based auto insurance provide full transparency to the policyholder, giving them more control over what they pay for their insurance and why.

Insurers therefore are embracing telematics and usage-based insurance quickly. As the data already shows, the market is not waiting.

About IMS

IMS (Insurance & Mobility Solutions) is a vehicle and driving data business, delivering enterprise solutions to over 350 customers including mobility operators, insurers and governments. IMS launched its Vehicle Data Exchange, which enables the IMS DriveSync platform to ingest and process data from any source – from OEM embedded units to smartphones and aftermarket hardware. The company, with offices in the UK, Europe and North America, has analyzed more than fifteen billion miles, feeding its algorithms with over a trillion data points.

About IMS Try Per Mile

IMS Try Per Mile is a highly configurable mileage based UBI product that enables you to swiftly configure and trial a mileage telematics program that can be deployed to customers in as little as one month. Try Per Mile enables you with the industry’s most customizable, most configurable mileage-based telematics proposition for your policyholders. Now you can charge per mile on-demand, and based on how, where and when policyholders choose to drive. Users also get access to value-added services direct notification on vehicle health, DTC codes and battery levels

Find out more: https://ims-2022.bgn.agency/mileage/

Data Sheet: IMS Try Per Mile: https://ims-2022.bgn.agency/resources/ims-try-per-mile/

White Paper: Building a Business Case for Insurance Telematics and UBI: https://ims-2022.bgn.agency/resources/building-a-business-case-for-insurance-telematics-and-ubi/